Not everyone gets the same paycheck all year round.

People who work in landscaping or the tourist industry make more money during the summer. School bus drivers make more money when school is in session. College students may work 10 hours/week during the semester, and full-time in the summer. And a freelance writer may get a big check every few months, and then get nothing the rest of the year.

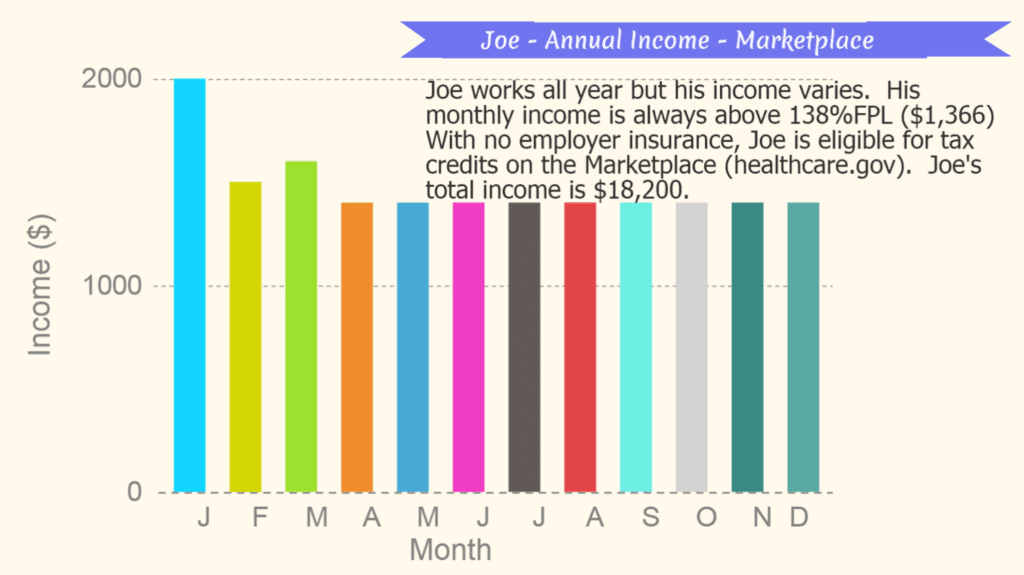

Marketplace Tax Credits Are Tied to Annual Income

On the Marketplace, subsidies are based on your annual income. If you have to provide income proof to the Marketplace, and your income fluctuates a lot, you may want to include a letter (possibly from your employer or accountant, if you have one) explaining that you don’t work the same hours all year. If your income varies during the year, but your modified adjusted gross income (line 37) on your taxes is about the same each year, you can use your tax return as proof of income.

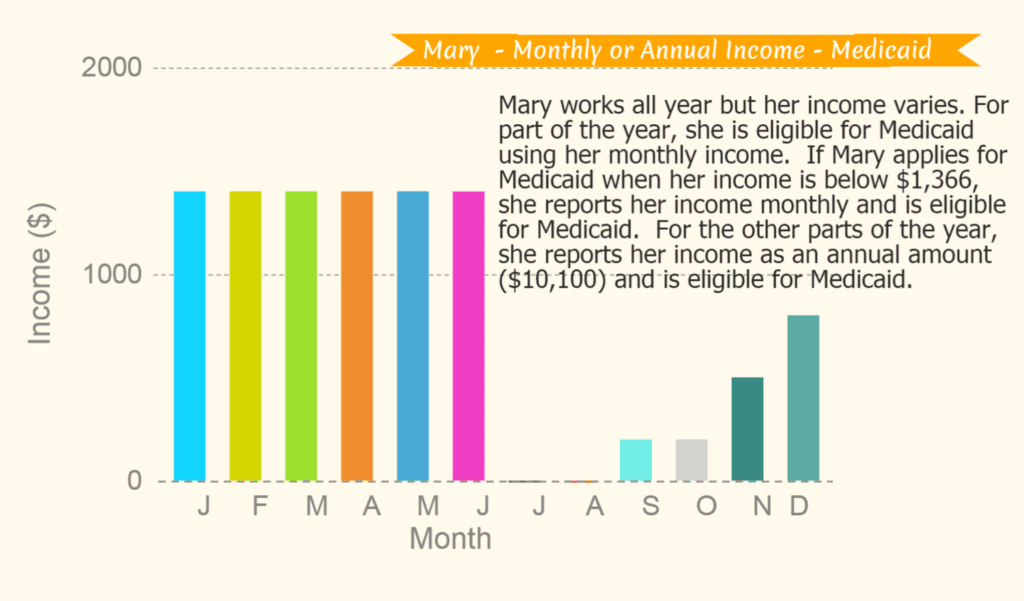

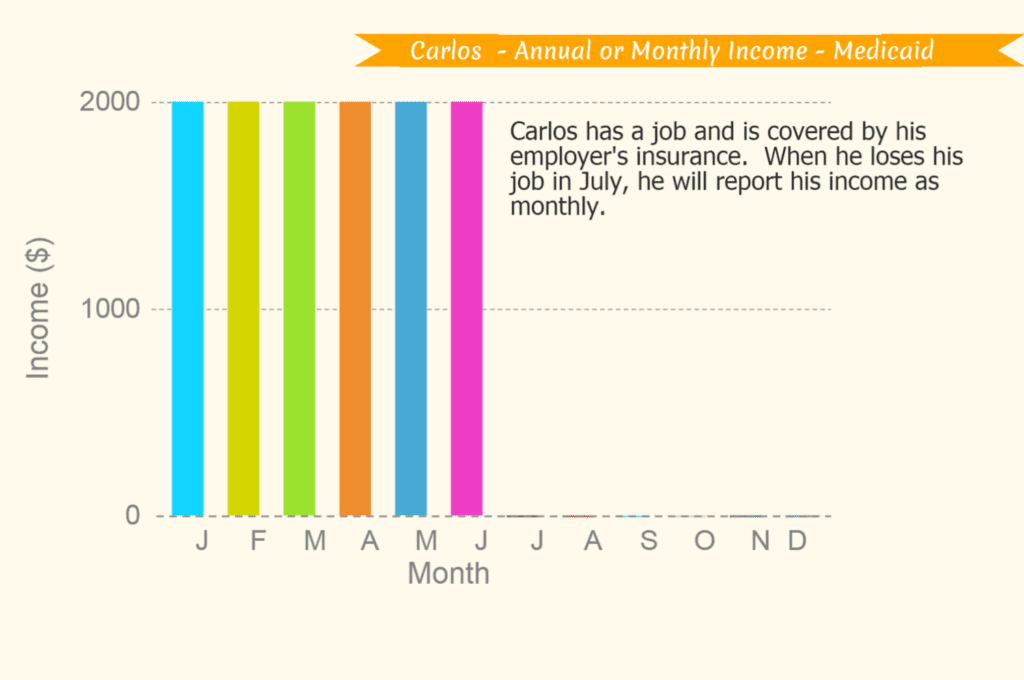

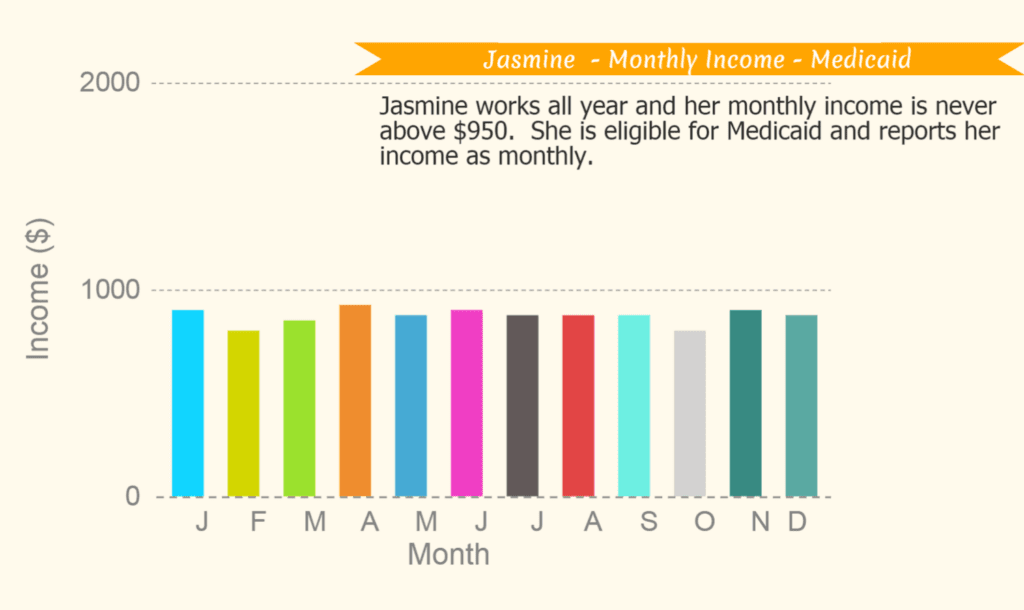

With Michigan Medicaid, Both Annual and Monthly Income Estimates Can Be Used

Annual income for both the Marketplace and Medicaid is your Modified Adjusted Gross Income (MAGI). Look at line 37 on your tax return, this is your income minus deductions. Monthly income is the gross amount you make per month.

- If you are paid weekly, multiply your weekly average by 4.3. Sally is paid every week and works 40 hrs per week. Her monthly income is $10/hr x 40hrs/week = $400/weekly gross x 4.3 = $1720/month.

- If you are paid bi-weekly (every two weeks), multiply your bi-weekly average by 2.15. Lucy’s gross pay is $685 (wages + tips) and she is paid every other week. Her monthly income is $685 bi-weekly gross x 2.15.

In sum: Before you do any applications, take a step back, and ask yourself what presentation of your income to use: annual, or monthly?